The path to a sustainable future is filled with incentives like the investment tax credit for energy property. This helps both the planet and your wallet. It can change your tax situation, making renewable energy investments more possible and attractive.

Take advantage of the clean energy tax credit. It covers many technologies, from solar panels to microturbines. This makes green energy more affordable for everyone.

Key Takeaways

- The investment tax credit for energy property encourages renewable energy use. It offers a 30% credit for properties under 1 MW.

- Clean energy tax credit scale-downs will start in 2033. They will adjust to 26%, then to 22% in 2034. This encourages early adoption.

- There’s no annual or lifetime dollar limit on the Residential Clean Energy Credit for most, except fuel cells. This is a great chance for homeowners.

- For bigger renewable projects over 1 MW, following prevailing wage and apprenticeship rules is key. This unlocks better credits.

- Eligibility for green energy tax credit now includes tax-exempt entities. They can get direct payments, thanks to the Inflation Reduction Act.

Understanding the Investment Tax Credit for Energy Property

The Investment Tax Credit (ITC) for energy property is a key part of U.S. policy. It helps grow the renewable energy sector by lowering taxes. This makes it easier for people and companies to invest in green energy.

What is the Investment Tax Credit for Energy Property?

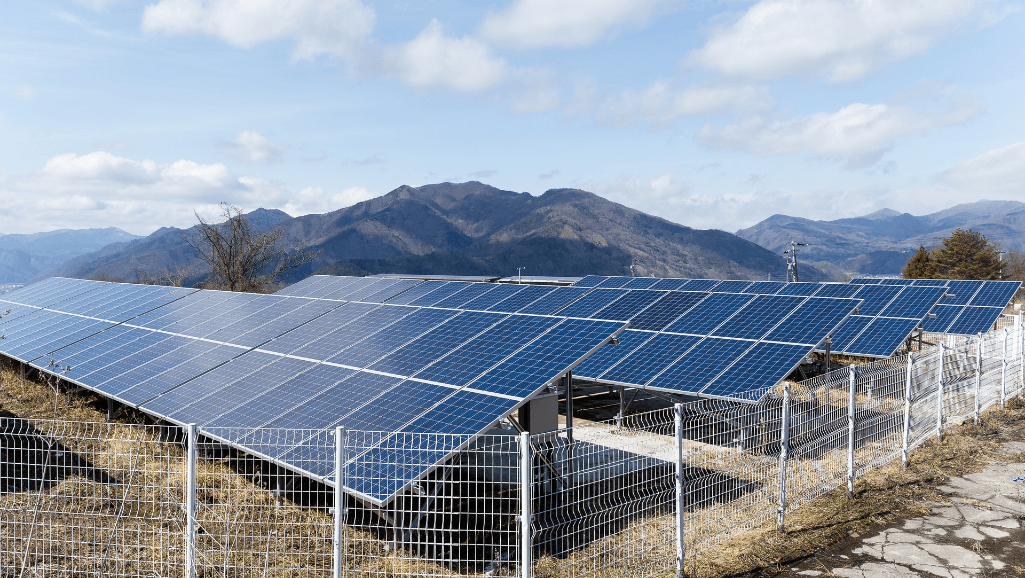

The ITC, found in Section 48 of the Internal Revenue Code, gives a base credit rate for certain energy projects. These include solar panels, wind turbines, and other green technologies. Projects starting construction by 2025 can qualify, helping the renewable energy industry grow.

How Does the Investment Tax Credit Work?

The ITC lets taxpayers deduct a part of the cost of eligible energy property from their taxes. The solar investment tax credit is 6% but can go up to 30% with certain conditions. This makes projects cheaper and encourages green energy investments.

Recent Modifications and Extensions

The Inflation Reduction Act of 2022 made big changes, adding new technologies and broadening what qualifies. It now includes energy storage and biogas, among others. These changes help more projects get tax credits, pushing for more green energy.

| Technology | Base Tax Credit Rate | Tax Credit with Conditions | Installation Timeline |

|---|---|---|---|

| Solar PV Systems | 26% | 30% | 2020-2032 |

| Geothermal Systems | 6% | Up to 30% | Begin by 2025 |

| Wind Turbines | Varies | Up to 30% | Begin by 2025 |

| Energy Storage | 6% | Up to 30% | Installed after Dec 2022 |

Knowing about tax credit changes is important for those looking to invest in renewable energy. It helps them make the most of the growing green energy market.

Eligibility Requirements for Energy Tax Credits

To get the federal tax credit for energy property, it’s key to know what properties qualify and who can get the credit. The energy investment tax credit aims to encourage people and businesses to invest in renewable energy. But, there are specific rules to follow to qualify.

Qualifying Energy Property Types

The IRS energy property credit covers many types of equipment and technology. This includes solar panels, wind turbines, geothermal heat pumps, and biomass stoves. Also, certain energy storage systems that meet efficiency standards are eligible. These must be installed in homes used as primary residences in the U.S.

This wide range of eligible properties helps support the adoption of green energy solutions. It encourages more people to invest in sustainable technologies.

Eligible Entities for the Investment Tax Credit for Energy Property

Many entities can get the energy investment tax credit if they meet certain standards. This includes not just homeowners but also tax-exempt organizations like government bodies and rural electricity cooperatives. But, these organizations must not use tax-exempt bonds to finance the energy properties.

Following these rules helps these entities reduce their carbon footprint and save on taxes. It’s a win-win for the environment and their finances.

Knowing the rules for the federal tax credit for energy property is crucial for anyone wanting to invest in energy-efficient upgrades. Whether you’re a homeowner or a business looking to go green, the IRS energy property credit offers a big financial incentive. It encourages environmentally friendly investments.

Incentives for Using Prevailing Wage and Apprenticeship in Projects

The Inflation Reduction Act has made it clear that following labor standards is key for federal tax incentives for energy projects. Meeting the requirements for prevailing wage and apprenticeship helps developers. They can follow the law and get big energy property tax incentives.

Starting January 29, 2023, workers on qualifying projects must get paid fairly, as the Davis-Bacon Act says. Also, a big part of the team must be apprentices from approved programs. This helps grow the clean energy workforce.

Following these rules is good for fair work and makes projects more valuable. Those who do it right can see their tax incentives grow five times. This big increase under clean energy tax incentives aims to help both workers and the industry.

| Key Requirement | Implementation Date | Impact on Tax Incentives |

|---|---|---|

| Prevailing Wage Compliance | January 29, 2023 | 5x Increase in Base Tax Incentive |

| Registered Apprenticeship Utilization | Scaling from 10% in 2023 to 15% in 2024 | Essential for Full Tax Credit Eligibility |

| Compliance with Labor Standards Laws | Ongoing | Mandatory for Federal and State Projects |

Strong labor standards and federal tax incentives for energy projects create a solid base for clean energy growth. This mix leads to better labor practices and makes renewable energy more affordable. It’s a step towards a workforce ready for today’s clean energy needs.

Profitability: Solar Investment Tax Credit and Other Renewable Energy Credits

The push for sustainable energy is growing, making upgrades more appealing. The Solar Investment Tax Credit (ITC) and other credits help with costs. They show the long-term benefits of these investments.

Increase Your Tax Savings with Solar Investment

Installing solar panels or geothermal heat pumps can save a lot on taxes. For example, businesses get a 30% tax credit for solar systems. This can cut down the initial costs a lot.

The Inflation Reduction Act has extended the ITC until 2034. This encourages more investment in renewable energy. With the ITC and other incentives, the savings can be huge.

The Role of Renewable Energy Tax Credit

Renewable energy tax credits do more than just save on taxes. They help businesses grow in the green market. This creates a strong, sustainable economy.

These credits make renewable technologies more affordable. They speed up the return on investment. This makes green energy systems more accessible to many businesses.

| Year of Installation | Residential Credit | Commercial Credit |

|---|---|---|

| 2020 – 2022 | 26% | 30% |

| 2023 | 22% | 30% |

| 2024 onwards (projected) | Expires unless renewed | 30% |

In summary, using the Investment Tax Credit and other credits is smart. It’s good for the environment and your wallet. These credits can lower your taxes and make investing in renewable energy more attractive.

Impact of Tax-Exempt Bonds and Dual Credit Restrictions

The mix of tax-exempt bonds and dual credit rules is key for investors in the energy sector. Using these tools with energy tax incentives can change how energy projects are funded. This is especially true with new laws.

Using tax-exempt bonds with the Investment Tax Credit (ITC) and Production Tax Credit (PTC) is beneficial. Projects get a 15% reduction in credit amounts. This makes it attractive for companies to use these bonds for tax benefits in energy property investment.

But, there’s a catch. You can’t use both the § 48 ITC and the § 45 PTC for the same place. You need to plan carefully to see which one helps more.

The table below shows how tax-exempt bonds work with ITC and PTC:

| Financing Option | Tax Credit Type | Credit Reduction | Annual Savings Estimate |

|---|---|---|---|

| Tax-exempt Bonds Only | N/A | 0% | $0 (No direct tax credit impact) |

| Tax-exempt Bonds + ITC | Investment Tax Credit | 15% | Varies by project scale and investment |

| Tax-exempt Bonds + PTC | Production Tax Credit | 15% | Dependent on production output |

By combining tax-exempt bonds with federal energy tax credits, companies can improve their finances. They make their energy projects more viable and profitable. It’s important for investors and operators to understand these options well.

Understanding tax laws for energy projects is crucial. The right use of tax-exempt bonds and energy tax incentives can lead to big improvements. This is a big step towards making energy investments more sustainable and efficient.

Calculating Your Federal Tax Credit for Energy Investments

Learning how to figure out your federal tax credit for energy investments can really help. This is especially true with the Inflation Reduction Act (IRA). It makes it easier to get energy tax credits.

Determining the Base Investment Tax Credit Percentage

To start, you need to know the base Investment Tax Credit (ITC). Most people get 6% of their investment back. This includes costs for solar and wind energy.

The solar energy property tax credit is 30% of the cost until 2032. It then goes down a bit each year. Knowing these rates is key to getting the most from your tax credits.

How to Maximize Your Credit with Domestic Content and Location Bonuses

Using materials and labor from the U.S. can boost your credit. This is called the domestic content bonus. It can make your total credit much higher.

Investments in certain areas can also get extra credits. This is called the location bonus. Keeping track of these details is crucial for getting the most credit.

Choosing the right location and materials is important. Knowing the IRA rules well can help a lot. It’s smart to check your energy tax credit eligibility carefully.

| Year | Base Credit Rate (%) | Potential Domestic Content Bonus (%) | Total Possible Credit (%) |

|---|---|---|---|

| 2032 | 30 | Up to 25 | 55 |

| 2033 | 26 | Up to 25 | 51 |

| 2034 | 22 | Up to 25 | 47 |

The IRA has made it a great time to invest in clean energy. Understanding these tax credits can make your green energy projects more profitable. It also brings economic benefits for a sustainable future.

The Residential Clean Energy Tax Credit: A Deep Dive

The Residential Clean Energy Tax Credit is key for homeowners to get solar energy systems. It shows the U.S. government’s push for renewable energy. This tax credit makes green energy more available to families.

The Essentials of the Residential Clean Energy Credit

The Residential Clean Energy Tax Credit offers a 30% non-refundable credit for solar projects from 2017 to 2033. This includes costs for solar panels and inverters. It helps save money and encourages more people to use clean energy.

Understanding the Phase-Down of the Credit Rate

The tax credit rate will go down after 2032. It will be 26% in 2033 and 22% in 2034. Then, it will end unless new laws are passed.

Energy storage systems also get a tax credit. They help make solar energy more stable. Homeowners must install these systems by the end of 2034 to get the credit.

To get this tax credit, homeowners need to file IRS Form 5695. The Inflation Reduction Act also lets homeowners transfer these credits. This can make it easier for them to afford solar systems.

These tax credits are part of a bigger effort to support renewable energy. They help lower the cost of solar systems. This supports individual energy freedom, national energy security, and caring for the environment.

This look into the Residential Clean Energy Tax Credit shows its big role. It’s not just a financial help. It’s a key part of the country’s energy policy for a greener future.

Defining Qualified Expenditures for Energy Property Tax Credit

Figuring out what costs qualify for energy tax credits for businesses is key. It’s important for those wanting to use IRS energy tax credits wisely. Knowing the details helps make the most of tax benefits for renewable energy projects.

Included and Excluded Expenses for Energy Tax Credit

To get the most from the energy property tax credit, it’s vital to know what counts. Costs like buying solar panels or wind turbines are included. But, things like interest or origination fees for financing aren’t.

Structural parts like roof trusses aren’t eligible, but solar tiles and related gear are. This makes a big difference in what you can claim.

Labor and Installation Costs in Qualified Expenses

The cost of labor for setting up energy property is a big part of the tax credit. It’s about getting the renewable tech up and running. This includes everything from the first design to the final installation.

For detailed guidance, businesses and investors should look at IRS Form 5695. It helps with filing for credits on renewable energy projects. This form is crucial for those looking to get the most from green investments.

In summary, knowing what costs qualify for IRS energy tax credits is crucial. As these credits grow and renewable energy becomes more important, understanding the rules helps make smart investment choices.

Navigating Rebates, Incentives, and the Effect on Tax Credit

It’s important to understand how different incentives and tax credits work together for energy projects. These benefits can lower costs upfront and increase returns over time. For example, the federal investment tax credit lets you deduct 30% of the cost of solar systems from your taxes.

Programs like Property Assessed Clean Energy (PACE) and state-specific initiatives help too. For instance, California’s solar tax exclusion keeps property values steady until 2025. This means your property taxes won’t go up because of solar systems.

It’s also key to know the difference between rebates and tax credits. Rebates, like those from California’s SGIP, lower costs right away. Tax credits, like the federal investment tax credit, reduce what you owe in taxes each year.

| Program | Incentive Type | Benefit | End Date |

|---|---|---|---|

| PACE | Tax Credit | Reduces installation costs | Continuous |

| California Solar Tax Exclusion | Exclusion | No added property tax | 2025 |

| NEM 3.0 | Net Metering | Adjusted solar export rates | Continuous |

| SASH | Rebate | Up to $3 per watt | Continuous |

The mix of financial incentives, including tax credits for energy projects, affects how viable and profitable renewable energy is. So, it’s crucial to plan carefully and strategically. This way, you can make the most of state and federal programs.

Claiming the Federal Solar Tax Credit

As we face climate change, more people are turning to sustainable tech. Claiming the Federal Solar Tax Credit is key. It makes solar energy systems more affordable and accessible in the U.S. Here’s how to get these benefits easily.

Steps to File for Solar and Renewable Energy Tax Incentives

To start, your solar PV system must be installed between 2006 and 2034. First, check if you qualify for the investment tax credit. Then, figure out how much credit you can get. Finally, fill out IRS Form 5695 with your solar system’s costs.

It’s smart to look at both state and federal benefits. For instance, a New Yorker could get a 25% state credit plus a 26% federal one. This combo can save a lot of money.

IRS Guidelines and Timing for Energy Property Tax Credits

Knowing IRS rules and deadlines is crucial for clean energy tax credits. The IRS says your solar system must work during the tax year you claim it. You’ll need proof of when it started and how much it cost. Also, remember that this credit is nonrefundable, so you might carry over any extra.

Here’s a quick table with important info:

| Year Installed | Credit Percentage | Important Consideration |

|---|---|---|

| 2020 – 2022 | 26% | Maintain system operational within the tax year |

| 2023 | 30% | Adhere to IRS Form 5695 completion |

| 2024 – 2034 | 30% | Carry forward unused credits if applicable |

Staying updated on policy changes is key to using these incentives well. Check out this guide for the latest info and tips.

Conclusion

Looking ahead, using renewable energy is key for our planet and our wallets. The investment tax credit for energy property is a big step for the U.S. in green energy. It can cut costs by up to 30% for many projects, pushing us towards cleaner energy.

The Federal Solar Investment Tax Credit (ITC) is a big help. It gives big tax breaks for using renewable energy, leading us to a cleaner future.

The tax credit program is a strong push, with no limit on how much you can claim. It changes based on when you start your project, helping us act fast for the planet. Many energy projects, like solar panels and wind turbines, are covered, helping the environment.

This program is flexible, growing with new technology. It lets us invest in more renewable energy as it becomes available.

Understanding the rules is crucial for success. Projects must use U.S. technology and last a long time. Knowing about possible changes, like tax credit phases or rules, is also important for planning.

In the end, the energy tax credit program is more than just saving money. It’s a step towards taking care of our planet for future generations. It’s a chance for everyone to make a difference.