The renewable energy companies are driving a rapid shift to cleaner power as solar technology, policy support, and corporate demand converge. By 2025, major solar companies from Spain, Denmark, China, the United States, and Canada are projected to shape market direction through large-scale projects, international installations, and expanded manufacturing capacity. Firms such as Spain’s Iberdrola SA illustrate how traditional utilities and dedicated solar companies are expanding installations and services to meet rising customer demand.

The solar sector’s momentum is visible in large daily investment flows and rising deployment: industry capital across projects, manufacturing, and installations now measures in the billions annually, reflecting strong investor interest and growing revenue streams for leading firms. Companies like NextEra Energy demonstrate how utilities and independent solar companies can become market leaders through project scale and strategic investments—reasons they appear on many lists of the best solar companies to watch.

Key Takeaways

- Solar energy companies are growing rapidly, combining manufacturing, project development, and installation services.

- Solar companies are attracting large-scale capital and expanding installation footprints, improving customer access to clean power.

- Technology advances and falling panel prices are accelerating adoption across residential and commercial markets.

- Major corporate buyers (Meta, Microsoft) and retailers are increasing demand through power purchase agreements and on-site projects.

- Federal and state incentives — including tax credits and financing programs — remain a primary driver of market growth and consumer savings.

- Top renewable companies are publicly committing to carbon-neutral targets, channeling money into long-term clean-energy strategies.

- The solar industry outlook through 2025 is positive for investors and customers, with continued growth in capacity, installations, and service offerings.

Read on to learn which companies, policies, technologies, and incentives are shaping the solar landscape through 2025 and how to compare providers for your next solar installation.

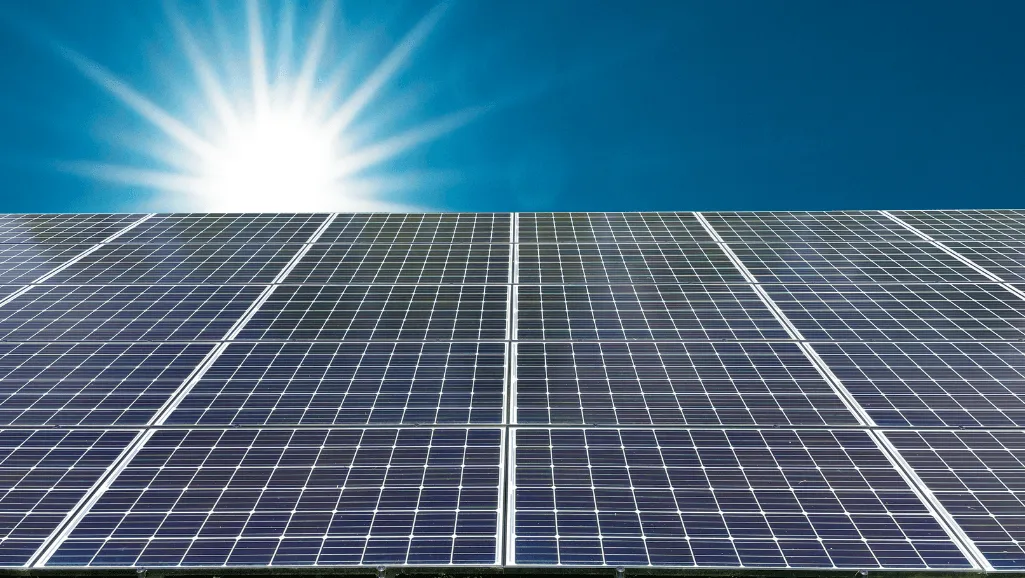

Emergence of Solar Power as a Mainstream Energy Source

Solar power has moved from niche technology to a mainstream source of electricity thanks to rapid capacity additions, falling costs, and stronger policy support. Technological improvements in modules, inverters, and energy storage — combined with legislative incentives — have made solar a competitive option across utility, commercial, and residential markets.

Global Growth of the Solar Energy Sector

Advances in solar technology and large-scale deployment have driven worldwide growth. The International Renewable Energy Agency (IRENA) and other agencies report substantial increases in renewable capacity over the last decade, with solar representing a growing share of new builds. This expansion is evident across regions and states where grid-scale and distributed installations are both rising.

Policy shifts are accelerating the transition from coal and other fossil fuels to cleaner sources. For example, multiple national energy outlooks note solar’s large contribution to reducing coal generation and supporting decarbonization targets.

Impact of Technology Advancements on Solar Energy Efficiency

Technological progress since the first modern silicon solar cell in 1954 has dramatically improved efficiency and lowered costs. Module efficiency gains, better balance-of-system components, and mass manufacturing have all contributed to steadily improving performance.

Installed system prices and module costs declined sharply in the 2010s, helping expand adoption across residential and commercial installations and making projects financially viable in more states and countries.

Legislative Initiatives Supporting Solar Energy Expansion

Legislation and policy incentives have played a key role in scaling the solar industry. Historic measures such as the Energy Tax Act of 1978 introduced early tax incentives for renewables, while later federal incentives—most notably the investment tax credit (ITC)—boosted large-scale and residential deployments by improving project economics.

As highlighted in a broader review of the sector’s foundations and frontiers (foundations and frontiers), these combined technology and policy drivers are expected to keep solar growth strong through 2030 and beyond.

| YearLegislationImpact | ||

| 1978 | Energy Tax Act | Introduced early tax incentives that supported residential and commercial renewable projects |

| 2005 | Federal Tax Credit (ITC) | Expanded investment incentives for solar installations, boosting project financing and growth |

| 2021 | Renewable Energy Cost Reduction | Ongoing cost declines made solar among the lowest-cost sources of new electricity in many markets |

The Global Leaders in Solar Energy Production

Countries and large energy groups are investing heavily to cut carbon emissions and scale sustainable electricity. Spain, Denmark, and China stand out for their policy support, industrial capacity, and presence of major renewable companies that drive deployment and technology adoption.

Spain’s Dominance with Iberdrola SA

Iberdrola SA is a major utility and renewable energy developer headquartered in Spain. The company has significantly expanded its renewables portfolio — including utility-scale solar farms and distributed-generation projects — while also operating large wind assets. Iberdrola’s integrated approach (generation, grid, and services) illustrates how established energy companies can accelerate solar deployment across markets and support customers transitioning to clean electricity.

Denmark’s Contribution through Vestas Wind Systems A/S

Vestas is globally known for wind turbines and remains a market leader in wind technology; its core expertise is wind, though the company engages in partnerships and service agreements across the broader renewables value chain. Rather than positioning Vestas as a primary solar manufacturer, note their role in supply-chain synergies and energy partners that help integrate renewable power systems at scale.

China’s Solar Advancements Led by Jinko Solar Holding Co. Ltd.

China has become the world’s largest manufacturer of solar modules and a major exporter. Companies such as Jinko Solar Holding Co., Ltd. lead in module shipments, R&D, and manufacturing scale — supplying panels domestically and to international markets. China’s manufacturing capacity has driven down module prices and accelerated installations across regions and states worldwide.

In summary, the combination of utilities and dedicated solar companies in these countries—backed by industrial capacity, policy support, and international project pipelines—continues to shape the global solar landscape. These firms demonstrate different roles: from large-scale developers and utilities to specialized solar manufacturers and energy partners integrating systems across markets.

Companies in Solar Energy: Shaping the 2025 Landscape

As 2025 approaches, the solar energy industry is expanding through a mix of large utilities, specialized manufacturers, and system integrators. Major firms — including GE Vernova (General Electric), Canadian Solar Inc., and Constellation Energy — illustrate different paths to scaling low‑carbon electricity: from manufacturing and project delivery to grid integration and long‑term power contracts.

GE Vernova has set public targets for emissions reductions and is investing in renewables and grid technologies as part of a broader corporate decarbonization roadmap; these initiatives demonstrate how legacy energy companies can transition toward renewable solutions and offer customers integrated services across generation and grid operations.

Canadian Solar operates globally and provides end‑to‑end solar power project capabilities — from module manufacturing to EPC (engineering, procurement, and construction) and operations. The company’s wide geographic reach shows how solar companies can deliver turnkey solar panel systems and long‑term service agreements across markets.

In the U.S., Constellation Energy is a significant provider of carbon‑free power through a mix of nuclear and renewables and by supplying wholesale clean energy to utilities and large corporate customers. Its business illustrates one route utilities and power producers take to add carbon‑free electricity to the national grid.

Technology advances remain a critical growth driver. Next‑generation module types, such as perovskite‑silicon tandem cells, promise higher efficiencies; while commercialization timelines vary, many manufacturers and research consortia expect pilot‑scale deployments within the next few years. For an extended look at these developments, see the detailed discussion on solar technology here.

The combined efforts of solar panel companies and solar installation companies are shaping 2025 by expanding manufacturing capacity, improving panel system efficiency, and offering more competitive pricing and financing options. Whether you’re evaluating the best solar companies for a home or a utility‑scale project, look for firms that also offer comprehensive warranties, local installation networks, and clear performance guarantees.

Strategic Corporate Investments in Solar Technology

Corporate solar investments are accelerating deployment and creating durable demand for modules, inverters, and storage systems. Large tech and retail firms are using a mix of on-site installations and contracted power purchase agreements (PPAs) to lower operating costs, meet sustainability goals, and secure reliable low-carbon energy for their data centers and operations.

Corporate Solar Adoption by Tech and Retail Giants

Leading corporations have built significant solar portfolios that combine installed capacity with off-site contracts. Reported figures (on-site plus contracted capacity) put Apple at roughly 393 MW, Amazon near 330 MW (including ~50 rooftop installations), Target about 242 MW, Walmart around 209 MW, and Google near 143 MW for direct projects tied to its data centers and campuses. These investments reduce energy expense volatility for those companies and create steady work for installation companies and service providers across the supply chain.

Meta’s Rise to Leading Corporate Solar User

Meta has become one of the largest corporate buyers of renewable energy, using PPAs and on-site projects to power data centers and operations. Corporate procurement like Meta’s drives new utility-scale projects in rural areas, often delivering jobs, local infrastructure upgrades, and longer-term revenue streams for community partners.

Solar Integration in Data Centers and Other Infrastructure

Deploying solar in data centers helps companies control costs and emissions, but it requires integration with storage, grid services, or firming power to meet reliability needs. Tech firms (Google, Intel, Microsoft) typically combine on-site arrays, regional PPAs, and battery storage to match data center demand profiles. This mixed approach is becoming the standard model for customers requiring high availability.

The table below shows how big companies are investing in solar:

| CompanyInstalled Solar Capacity (MW)Solar Projects Count | ||

| Apple | 393 | – |

| Amazon | 330 | 50 rooftop installations |

| Target | 242 | – |

| Walmart | 209 | – |

| 143 | – |

Corporate buying has a ripple effect: it signals demand to manufacturers, stabilizes revenues for developers, and increases business for local installers and maintenance services. For customers evaluating vendors or installers, look at whether a company also offers long-term operations and maintenance, performance guarantees, and financing options that lower upfront money needed for an install.

Innovative Solar Solutions Driving Industry Growth

The push for solar solutions innovation is accelerating improvements across panels, inverters, and storage systems. Breakthroughs in photovoltaic (PV) materials and energy storage are making solar installations more efficient and reliable for residential, commercial, and utility customers — and they’re helping equipment manufacturers and service providers scale faster.

Breakthroughs in Photovoltaic Systems

Research and commercial development have steadily raised PV conversion efficiency. Lab records for cell technology (for example, recent perovskite‑silicon and tandem cell advances) show higher theoretical efficiency limits than older silicon-only cells, but it’s important to distinguish cell‑level records from commercially available module efficiency. Oxford PV and other research groups have reported high single‑cell efficiencies in lab conditions; translating those gains to production modules takes additional engineering and time.

For customers and installers, higher module efficiency typically means more energy per square foot — useful where roof or site area is limited — and can lower balance‑of‑system costs for a given output. When comparing the best solar panel options, pay attention to rated module efficiency, warranty, and tested performance in field conditions.

Energy Storage and Efficiency Technologies

As more solar panels come online, battery storage becomes essential to smooth output and match generation to demand. Storage systems range from small residential battery backups to multi‑hour utility batteries that firm large-scale solar output. Residential solar panel systems commonly pair 5–20 kWh battery systems, while utility projects can deploy hundreds of MWh of capacity to provide grid services.

Companies across the value chain are improving battery chemistry, inverter efficiency, and system controls to increase round‑trip efficiency and lifetime. These advances help reduce the effective cost of solar‑plus‑storage projects and make solar power a more reliable substitute for conventional dispatchable generation.

In short, photovoltaic and storage innovations are more than lab headlines: they materially affect equipment selection, system design, and long‑term performance for customers, installers, and utility planners. Use performance data and warranty terms when evaluating suppliers and panel system equipment.

Market Trends and Financial Insights for Solar Firms

The solar industry has shifted from subsidy‑driven growth to market fundamentals: falling module prices, larger-scale projects, and rising corporate and residential demand. These trends are reshaping revenue models for manufacturers, developers, and installers and creating new opportunities for investors seeking exposure to clean energy.

Stock Performance of Leading Solar Companies

Publicly traded solar and renewable energy companies have shown mixed but generally positive performance as the sector matures. While individual stock returns depend on company strategy and balance‑sheet strength, many leading solar companies have benefited from stronger order books, long‑term PPAs, and expanding service revenues. Investors often focus on firms with diversified businesses (manufacturing + project development + O&M) to reduce exposure to single‑point risks.

Revenue and Market Capitalization Analysis

Over the past decade, revenue streams in the sector have diversified: module manufacturers, project developers, and installers now generate income from equipment sales, contracted power, and recurring operations and maintenance services. This diversification has helped some companies grow market capitalization even when module prices pressured margins.

Examples include large utilities and developers that have expanded their renewable portfolios to capture scale advantages. When evaluating companies, look at three metrics: recent revenue growth, gross margin on equipment vs. project revenue, and backlog or contracted pipeline (MW) — these give a clearer picture than headline market cap alone.

The global solar power market continues to attract capital as forecasts show multi‑year growth driven by technology improvements and policy support. That said, investors should weigh sector-specific risks (material costs, supply chain disruptions, tariff and trade actions, and policy changes) and consider diversification or targeted exposure to segments such as storage or services that may offer higher average margins.

Best Solar Energy Companies’ Strategies for Sustainability

Top solar companies are pursuing measurable sustainability strategies that combine increased renewable generation, improved manufacturing practices, and commitments to circularity. These efforts deliver environmental benefits while supporting economic growth through job creation and local investment.

Corporate Commitments to 100% Renewable Energy Targets

Many leading firms have set public targets to source 100% renewable energy for operations or achieve net‑zero emissions by set dates. These commitments typically combine on‑site solar installations, off‑site PPAs, and investments in storage or grid upgrades. Companies that aim for 100% renewables also often partner with local installers and energy partners to scale deployment and ensure reliable service for customers.

Environmental and Economic Impact of Solar Initiatives

Solar initiatives produce both environmental gains and economic opportunities. Cleaner electricity reduces greenhouse gas emissions, while project development and installation create jobs across manufacturing, construction, and operations and maintenance.

Key performance indicators help track progress and context for customers and investors:

| StatisticValueContext / Source | ||

| Annual Industry Growth Rate | ~24% | Indicative growth in certain markets reflects rapid capacity additions (cite regional reports) |

| Decrease in Installation Costs Since 2010 | ~70% | Significant decline in installed cost driven by module price drops and scale |

| U.S. Residential Solar Installations in Q1 2023 | 1,641 MWdc | Quarterly installation snapshot showing year‑over‑year growth in residential installations |

| GHG Emissions Reduction by Leading Suppliers | Example: 32% | Reported reductions from some manufacturers reflect efficiency and operational improvements year‑over‑year |

| Efficiency Records by Module Innovators | Multiple records | Manufacturers like Trina and others have posted numerous cell/module efficiency milestones |

How this affects customers: lower cost solar means faster payback, more attractive financing options, and broader access to panel system installations for homeowners and businesses. When comparing the best solar companies, prioritize those that offer transparent performance data, solid warranties, and bundled services (installation, monitoring, and maintenance).

For readers who want to compare company sustainability claims, consider linking to third‑party sustainability reports or a consolidated comparison of the best solar companies’ environmental performance and service offerings.

Top Solar Companies Leading in Innovation and Quality

The solar industry is advancing rapidly thanks to companies that combine R&D, manufacturing scale, and large project pipelines. Firms such as NextEra Energy, First Solar Inc., and JinkoSolar are driving innovation in project development, panel production, and module efficiency — all critical to lowering costs and improving system performance for customers.

NextEra Energy’s Pioneering Solar Projects

NextEra Energy has become a leader in large‑scale solar projects and integrated renewable generation. Its portfolio of utility‑scale installations and long‑term power contracts demonstrates how developers can deliver grid‑scale capacity while supporting reliability and lowering wholesale power prices for utilities and corporate customers.

First Solar Inc.’s Expansion in Solar Panel Production

First Solar focuses on thin‑film module manufacturing for large projects and has announced capacity expansions to support U.S. project demand. Plans to scale manufacturing capacity highlight the company’s role in supplying integrated panel systems for utility and commercial installations.

When comparing modules, look at real‑world module efficiency, degradation rate, and warranty terms rather than lab headline numbers alone. Our best solar panels guide compares top brands on these practical metrics.

| CompanyFocus AreaRecent Achievement | ||

| NextEra Energy | Solar Projects | Leader in large-scale utility solar development and PPAs |

| First Solar Inc. | Manufacturing Expansion | Scaling thin-film production to support major project pipelines |

| JinkoSolar | Efficiency & Innovation | High-volume module shipments and ongoing R&D into higher-efficiency cells |

These companies represent different pieces of the solar value chain — development, manufacturing, and module innovation — and together they push the industry toward lower costs and higher quality. For homeowners and commercial buyers, consult a short list of trusted installers and review performance data, warranties, and total system price when choosing among the best solar companies.

Consumer Adoption and the Solar Energy Market Surge

The solar energy market is expanding rapidly as more homeowners and businesses choose solar to lower energy bills, increase resilience, and meet sustainability goals. Falling equipment prices, better panel performance, and expanded financing options are making solar accessible to a wider range of customers.

Residential Versus Industrial Solar Energy Implementation

Residential solar energy installations typically range from 4 kW to 12 kW for single‑family homes and are often paired with inverters like the SolarEdge Home Wave Inverter or comparable models to maximize production. Homeowners benefit from lower monthly electricity costs and can use federal and state incentives to reduce upfront money. Typical payback periods vary by state, system size, and local electricity prices.

Industrial and commercial deployments are much larger — from a few hundred kW up to hundreds of MW — and focus on lowering operating costs, meeting corporate renewable targets, and securing long‑term price stability through on‑site generation or off‑site PPAs. These projects often require different permitting, interconnection, and O&M arrangements than residential installs.

Growth of Solar Installations in Urban and Rural Areas

Installations are rising in both urban rooftops and rural utility‑scale sites. Urban projects optimize limited roof or parking‑lot space with higher‑efficiency panels, while rural and suburban utility projects take advantage of larger land parcels to deploy utility‑scale arrays and storage. States such as California have led in cumulative capacity for years, and Texas is rapidly growing share due to large project pipelines and favorable project economics.

Residential solar is increasingly affordable for mainstream households thanks to lower panel prices and more financing choices; for many customers, a properly sized panel system can significantly reduce monthly electricity costs. When homeowners decide to install solar, they should compare local companies, warranties, and estimated production — and verify installer credentials, equipment warranties, and performance guarantees.

Government Incentives Fueling the Solar Power Companies

The solar sector’s rapid growth is tightly linked to government solar incentives and energy policies that improve project economics and expand market access. Financial incentives reduce upfront money barriers, while policy frameworks encourage investment in manufacturing, installations, and grid integration — creating clearer pathways for companies to scale and for customers to install solar.

Subsidies and Policies Contributing to Solar Industry Expansion

Policy tools go beyond direct subsidies. The federal investment tax credit (ITC) — often referenced as the federal solar tax or federal tax credit — remains a central mechanism that lowers net project costs for homeowners and businesses. Current rules provide a substantial percentage credit for qualifying installations through specified dates; eligibility and exact credit rates can vary by project type and year, so verify your specific situation before you install.

State and local programs also play a major role. For example, PACE financing (Property Assessed Clean Energy) in Kentucky and other states helps commercial and some residential customers spread installation costs over time with low‑interest financing tied to property tax assessments. These programs reduce the immediate money needed to install solar and encourage more companies and customers to move forward with projects.

Case Studies: Government-backed Solar Projects

Public–private partnerships and government‑backed projects demonstrate how incentives translate into real deployments that benefit local economies. Below is an illustrative cost snapshot and the kinds of incentives that typically apply; always confirm current local pricing and incentive availability before budgeting a project.

| Kentucky Solar Panels CostFederal Solar Tax CreditKentucky Incentives | |||

| 6 kW system: $19,140 | 8 kW system: $25,520 | 10 kW system: $31,900 | 30% credit on federal taxes for qualifying installations (check current program dates and eligibility) |

- PACE Financing

- One-time income tax credit for non-fossil fuel energy

- Cash-back rebates for energy-efficient upgrades

- Net Metering benefits

Practical tip: to estimate net cost, subtract applicable tax credits from the installed price, then factor in state rebates and financing. Use an incentive finder or consult a local installer to confirm available programs in your state and to determine whether you qualify for federal solar tax credits or local rebates.

By combining policy support with financing tools, government‑backed incentives reduce the effective cost of solar, spur installations across states, and help both companies and customers capture value from lower operating expenses and long‑term energy savings.

Future Projections for Solar Panel Companies and Industry Dynamics

The dynamics for solar panel companies are evolving rapidly as module supply, financing, and grid integration converge. Recent industry forecasts point to strong capacity additions and growing market value, but outcomes will depend on technology deployment, policy consistency, and supply‑chain resilience. Stakeholders should plan for both upside and downside scenarios and adapt procurement and investment strategies accordingly.

Anticipated Technological Disruptions in Solar Energy

Technology improvements remain a primary growth driver. Continued gains in module efficiency, reductions in manufacturing cost, and advances in storage are lowering the effective price of delivered solar power. Some analysts project module commodity prices could move significantly lower as polysilicon supply expands and new production comes online, but beware that $0.10/W projections typically refer to module component prices rather than total installed cost.

For companies and customers, technological disruption creates opportunities to reduce balance‑of‑system (BOS) costs and improve energy yield for a given roof or field area. That makes selecting the right panel system and pairing it with storage or grid services an increasingly strategic decision.

Forecasting the Solar Industry’s Path Beyond 2025

Near‑term projections show continued rapid additions to global and regional solar capacity and rising installations across states. Forecasts vary by source, but common themes include: rising household adoption, expanded community solar programs, and significant utility‑scale deployments backed by corporate and public off‑takers.

Scenario planning is useful here:

- Base case: steady growth driven by technology and policy, continued declines in module and system prices, broader adoption of solar‑plus‑storage.

- Optimistic case: faster commercialization of high‑efficiency panels and lower module prices, accelerating deployment and market size.

- Downside case: supply‑chain disruptions, tariff actions, or policy changes that slow capacity additions and raise average installed costs.

Practical actions for companies and customers: secure multi‑year supply agreements where possible, consider PPAs to lock long‑term prices for power, and evaluate storage options to maximize the value of a solar installation. For homeowners, locking in equipment and installation quotes can hedge near‑term price fluctuations.

Longer‑term market estimates often show substantial growth in market size and household penetration; such projections underline why many companies are scaling manufacturing and services now. Whether you are assessing a purchase of a residential solar panel system or planning corporate investments, use scenario analysis, review vendor data, and consider contracting approaches that match your risk tolerance and timeframe.

Conclusion

Solar energy is poised to play a central role in the world’s transition to cleaner electricity. Continued improvements in panel efficiency, falling installed costs, and expanding storage options make solar a practical choice for many customers — from homeowners to utilities — while policy support and corporate procurement help scale the market.

That said, deployment requires careful planning: siting, lifecycle impacts, recycling, and grid integration all matter. Panels typically carry warranties for 25–30 years, but responsible companies and regulators are also developing recycling and circular‑economy practices to limit environmental impacts at end of life.

Governments, companies, and installers are working together to expand renewable capacity, supported by incentives such as the federal tax credit and various state programs. These measures reduce upfront money and improve project returns, making it easier for more households and businesses to install solar panel systems.

Next steps for readers: compare installers, check available incentives, and consider whether a solar panel system with or without storage best meets your needs. For homeowners, a short feasibility check — estimated system size, payback time, and available tax credits — is an effective first step toward deciding to install solar.

Overall, despite challenges on land use, materials, and grid integration, the future looks bright: solar will remain a foundational technology in efforts to decarbonize electricity and reduce long‑term energy costs for customers and companies alike.