Looking to harness the power of the sun and save on your energy bills? Texas is leading the charge in solar energy, ranking second nationwide in solar power production. With a mix of solar rebates, renewable energy incentives, and solar panel tax credits, the Lone Star State offers numerous ways to make your switch to solar more affordable.

While Texas doesn’t have a statewide solar rebate program, homeowners can still benefit from the federal solar tax credit and local utility company incentives. The average cost of a 6-kW solar system in Texas is $16,320 before applying the 30% federal tax credit, which is below the national average. This solar energy investment not only reduces your carbon footprint but also provides long-term savings on your electricity bills.

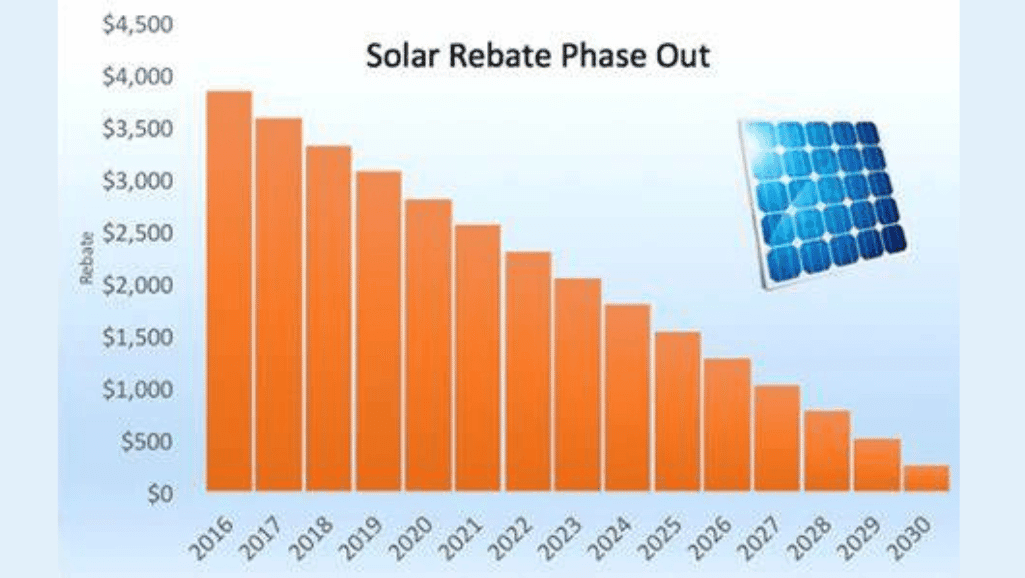

The federal solar tax credit, also known as the Investment Tax Credit (ITC), is a significant incentive for homeowners considering solar installation. Currently set at 30% of the total system cost, this credit will decrease to 26% in 2033 and phase out completely in 2035 if not renewed by Congress. This means now is the perfect time to take advantage of these substantial savings.

In addition to federal incentives, Texas offers property tax exemptions for solar installations. This means the added value of your solar system won’t increase your property taxes. Some local utilities also provide rebates and incentives, further reducing the upfront cost of going solar.

Key Takeaways

- Texas ranks second in the U.S. for solar power production

- Federal solar tax credit currently covers 30% of total system cost

- Average 6-kW solar system in Texas costs $16,320 before incentives

- Property tax exemptions available for solar installations in Texas

- Local utility companies offer additional rebates and incentives

- Now is an optimal time to invest in solar energy for maximum savings

Understanding Solar Energy Systems

Solar energy systems are becoming increasingly popular as homeowners seek green energy rebates and solar installation rebates. These systems harness the sun’s power to generate clean electricity for your home.

How Solar Panels Work

Solar panels contain photovoltaic cells that convert sunlight into electricity. When sunlight hits these cells, it creates an electric field, generating a flow of electrons. This process produces direct current (DC) electricity, which is then converted to alternating current (AC) for home use.

Components of a Home Solar Energy System

A typical home solar energy system consists of several key components:

- Solar panels

- Inverter

- Mounting equipment

- Optional battery storage

Benefits of Solar Power for Homeowners

Installing a solar energy system offers numerous advantages for homeowners:

| Benefit | Description |

|---|---|

| Lower electricity bills | Reduce or eliminate monthly electric costs |

| Energy independence | Generate your own power, reducing reliance on the grid |

| Environmental impact | Decrease your carbon footprint by using clean energy |

| Increased home value | Solar installations can boost property value |

With over 200 days of sunshine annually, Texas is an ideal location for solar energy production. Homeowners can take advantage of photovoltaic system incentives to make the switch to solar more affordable. These incentives, combined with the long-term savings on energy costs, make solar power an attractive option for many Texas residents.

The Cost of Solar Installation in Texas

Texas ranks among the top 10 solar states since 2017, with installations capable of powering over 935,000 homes. The Lone Star State’s sunny climate, averaging 236.8 days of sunlight yearly, makes it ideal for solar energy investments.

Solar power subsidies in Texas have made installations more affordable. A typical 6 kW system costs around $16,000 before incentives, dropping to $11,200 after applying solar energy tax benefits. This price point is lower than the national average of $17,000 for similar systems.

| System Size (kW) | Cost Before Incentives | Cost After Federal Tax Credit |

|---|---|---|

| 3 | $6,899 | $4,829 |

| 5 | $11,499 | $8,049 |

| 7 | $16,098 | $11,269 |

| 10 | $22,998 | $16,099 |

The average cost per watt in Texas is $2.30, lower than the national average. This competitive pricing, combined with an estimated 20-year savings of $57,330 on electricity costs for a 5 kW system, makes solar installation an attractive option for Texan homeowners.

Local incentives further sweeten the deal. Austin Energy offers a $2,500 rebate program, supporting nearly 6,300 residential solar systems. In Dallas, Farmers Electric Cooperative members can receive up to $1,000 in rebates for energy-efficient upgrades.

With a payback period of just 6.57 years, going solar in Texas offers long-term financial benefits, increased energy independence, and reduced environmental impact.

Federal Solar Tax Credit: The Investment Tax Credit (ITC)

The federal solar tax credit, known as the Investment Tax Credit (ITC), is a key part of clean energy rebate programs. This incentive aims to boost sustainable energy initiatives across the United States.

What is the federal solar tax credit?

The ITC is a 30% tax credit for residential solar systems. It’s part of Section 25D of the tax code. This credit helps homeowners save money on their solar installations.

How much can you save with the ITC?

The savings can be substantial. For example, if your solar system costs $15,000, you could claim a $4,500 tax credit. This credit directly reduces your federal income taxes.

Eligibility requirements for the federal tax credit

To qualify for the ITC, you need to meet certain criteria:

- You must own the solar system (not lease it)

- The system must be installed at your primary or secondary residence

- The solar panels must be new or being used for the first time

| Year | Residential Credit | Commercial Credit |

|---|---|---|

| 2022-2032 | 30% | 30% (+ up to 24% for labor standards) |

| 2033 | 26% | 26% |

| 2034 | 22% | 22% |

The ITC has helped the U.S. solar industry grow by over 200 times since 2006. It’s a powerful tool in promoting clean energy and reducing carbon emissions.

Texas Property Tax Exemption for Solar Installations

Texas offers a generous property tax exemption for solar installations, making it a prime location for homeowners seeking renewable energy incentives. The Lone Star State provides a 100% exemption on the increased property value due to solar panel installations. This means your property taxes won’t rise when you add solar panels to your home.

Let’s break down how this works. If you own a $350,000 home and install a $25,000 solar system, your property taxes will still be calculated based on the original $350,000 value. This renewable energy incentive can lead to significant savings over time.

To qualify for this exemption, you must:

- Own both the property and the solar system on January 1 of the tax year

- File an application by April 30 of the applicable year

- Provide details about the installation date and system output in kilowatts

It’s important to note that leased solar panels don’t qualify for this exemption. However, if you own your system, you can enjoy the benefits of increased home value (up to 4.1% in Texas) without the burden of higher taxes.

| Exemption Type | Eligible Devices | Exemption Percentage |

|---|---|---|

| Solar Property Tax Exemption | Solar PV panels, solar water heaters, solar pool heaters | 100% of added value |

While Texas doesn’t offer a state-level solar tax credit, this property tax exemption, combined with the federal solar tax credit, makes going solar an attractive option for many Texans. With abundant sunshine year-round, investing in solar can lead to substantial long-term savings on your energy bills and property taxes.

Local Texas Solar Rebates and Incentives

Texas offers various green energy rebates to encourage solar panel adoption. These local incentives, combined with solar panel tax credits, make switching to solar power more affordable for homeowners across the Lone Star State.

American Electric Power SMART Source Solar PV Program

AEP Texas provides rebates for residential solar installations. The program offers between $1,500 to $3,000 based on your system’s capacity. This incentive helps offset the initial cost of solar panel installation, making clean energy more accessible.

Austin Energy Solar Photovoltaic Rebates & Incentives

Austin Energy rewards homeowners with a $2,500 rebate for installing a 3 kW or larger solar system. To qualify, you must complete a solar education course. This program not only provides financial benefits but also ensures homeowners are well-informed about their solar investment.

Oncor Residential Solar Program

Oncor offers rebates for solar panel systems ranging from 3 to 15 kW. While the exact amount varies, this program includes incentives for battery storage installation, enhancing your home’s energy independence.

SMTX Solar PV Rebate

San Marcos residents can benefit from the SMTX Solar PV Rebate. This program provides $1 per watt up to $2,500 for qualifying systems, not exceeding 50% of the total system cost. It’s a significant boost for homeowners looking to embrace solar energy.

| Program | Rebate Amount | System Size Requirement |

|---|---|---|

| AEP SMART Source | $1,500 – $3,000 | Varies |

| Austin Energy | $2,500 | 3 kW or larger |

| Oncor Residential | Varies | 3 – 15 kW |

| SMTX Solar PV | Up to $2,500 | Varies |

These local incentives, coupled with federal solar panel tax credits, can significantly reduce the cost of going solar in Texas. Remember to check with your local utility provider for the most up-to-date information on available rebates and eligibility criteria.

Net Metering Opportunities in Texas

Texas lacks a statewide net metering policy, but many local utility companies offer solar buyback programs. These programs let homeowners sell extra solar energy back to the grid for bill credits or payments. This setup creates unique opportunities for those considering solar installation rebates and photovoltaic system incentives.

In deregulated areas, which cover about 85% of Texas, residents can choose their Retail Electric Providers (REPs). This choice impacts the cost-effectiveness of going solar. Out of over 100 REPs in Texas, a select few offer solar buyback plans for homeowners.

These plans come in three main types:

- Uncapped credit plans: Allow unlimited credits for excess solar energy

- Capped credit plans: Limit credits to the amount of energy used monthly

- Real-time metering plans: Credit instantly at retail market prices

For example, CPS Energy in San Antonio offers a net billing plan. It credits solar energy up to monthly usage at full-retail rate, with excess credited at a lower rate. When exploring photovoltaic system incentives, consider factors like REP services, system size, and electricity consumption to maximize your savings.

| Plan Type | Credit Limit | Potential Savings |

|---|---|---|

| Uncapped | No limit | Highest |

| Capped | Monthly usage | Moderate |

| Real-time | Varies | Fluctuates |

While Texas doesn’t have a uniform net metering policy, these diverse buyback programs offer substantial benefits for solar-powered homes. By understanding these options, you can make informed decisions about solar installation rebates and maximize your energy savings.

Calculating Your Potential Savings with Solar Rebates

Understanding the financial benefits of solar power involves estimating energy production, considering local electricity rates, and factoring in solar power subsidies. Let’s break down these components to help you calculate your potential savings.

Estimating Energy Production

The energy output of your solar system depends on its size and local sunlight conditions. In Texas, a typical 6-kW system can generate over 9,500 kWh annually. This significant production capacity translates to substantial savings on your electric bills.

Factoring in Local Electricity Rates

Texas electricity rates average 14.26 cents per kWh. With a 6-kW system’s annual production, homeowners could save more than $1,350 yearly on electricity costs. These savings contribute to a sustainable energy future while reducing your carbon footprint.

Long-term Financial Benefits

The long-term benefits of solar installations are impressive when you consider solar energy tax benefits and ongoing savings. A solar system with a net cost of $10,290 could pay for itself in 7-8 years, with warranties lasting up to 30 years.

| System Size | Annual Production | Yearly Savings | Payback Period |

|---|---|---|---|

| 6 kW | 9,500 kWh | $1,350 | 7-8 years |

With rising electricity costs and generous solar power subsidies, investing in solar energy offers substantial financial benefits over time. Homeowners can enjoy reduced energy bills, increased property value, and contribute to a cleaner environment.

Choosing the Right Solar System for Your Texas Home

Texas offers ideal conditions for solar power with its abundant sunshine. Selecting the right solar system for your home involves considering energy consumption, roof characteristics, and budget. Clean energy rebate programs and sustainable energy initiatives make solar more accessible than ever.

Three main types of solar panels are available for homes: monocrystalline, polycrystalline, and thin film. Each has its advantages, so it’s crucial to consult with professionals to determine the best fit for your needs.

When exploring solar options, keep these factors in mind:

- System size (typically 3-10 kW for residential use)

- Roof orientation (south-facing is optimal)

- Shade coverage

- Current electricity bills

- Available incentives and rebates

Texas homeowners can benefit from various financing options, including zero money down plans. The federal solar tax credit covers 30% of the total project cost, making solar more affordable.

To maximize your investment in sustainable energy initiatives, consider these tips:

- Get multiple quotes from reputable solar providers

- Review warranty offerings and customer service ratings

- Explore participation in solar buyback programs or net metering

- Plan for regular maintenance to ensure optimal performance

| Feature | Solar Panels | Generators |

|---|---|---|

| Cost Range | $15,000 – $30,000 | Varies widely |

| Power Capacity | 3 – 10 kW | 5 – 20 kW |

| Noise Level | 25 – 40 dB | 70 – 90 dB |

| Lifespan | 25 – 30 years | 5 – 10 years |

| Emissions | Zero | High carbon footprint |

By choosing the right solar system, you can reduce your carbon footprint, lower electricity bills, and potentially increase your home’s value by 3-4%. With proper planning and utilization of clean energy rebate programs, your solar investment can pay off in 5-10 years.

Conclusion

Solar rebates and renewable energy incentives in Texas create a fertile ground for homeowners to embrace clean energy. The Lone Star State’s abundant sunshine, coupled with attractive solar panel tax credits, make the switch to solar power both environmentally friendly and financially savvy. Federal tax credits, local rebates, and property tax exemptions significantly reduce the upfront costs of installation.

Net metering opportunities further sweeten the deal, allowing homeowners to earn credits for excess energy production. These combined benefits can lead to substantial long-term savings on energy bills. As electricity rates continue to rise, the value of solar investments becomes even more apparent.

By tapping into these solar rebates and incentives, Texas homeowners can reduce their carbon footprint while increasing energy independence. The financial advantages, coupled with the environmental benefits, make solar power an attractive option for those looking to future-proof their homes against rising energy costs.

FAQ

How do solar panels work?

What are the benefits of solar power for homeowners?

How much does a solar installation cost in Texas?

What is the federal solar tax credit?

How does the Texas property tax exemption for solar installations work?

What local solar rebates and incentives are available in Texas?

How does net metering work in Texas?

What are the potential savings with solar rebates in Texas?

How do solar panels work?

What are the benefits of solar power for homeowners?

How much does a solar installation cost in Texas?

What is the federal solar tax credit?

How does the Texas property tax exemption for solar installations work?

What local solar rebates and incentives are available in Texas?

How does net metering work in Texas?

What are the potential savings with solar rebates in Texas?

FAQ

How do solar panels work?

Solar panels convert sunlight into electricity through photovoltaic cells. A typical home solar energy system includes solar panels, inverters, mounting equipment, and optional battery storage.

What are the benefits of solar power for homeowners?

Benefits of solar power for homeowners include reduced electricity bills, increased energy independence, and a smaller carbon footprint.

How much does a solar installation cost in Texas?

The average cost of a 6-kW solar system in Texas is ,320 before applying the 30% federal tax credit, which is below the national average.

What is the federal solar tax credit?

The federal solar Investment Tax Credit (ITC) offers a 30% tax credit on the total cost of solar panel installation. For a ,000 system, homeowners can claim a ,500 tax credit.

How does the Texas property tax exemption for solar installations work?

Texas offers a 100% property tax exemption for the added home value from solar panel installations. This means homeowners won’t face increased property taxes due to solar panels increasing their home’s value.

What local solar rebates and incentives are available in Texas?

Various utility companies in Texas offer solar rebates, including AEP, Austin Energy, Oncor, SMTX Utilities, CPS Energy, and Denton Municipal Electric. Rebate amounts and eligibility requirements vary.

How does net metering work in Texas?

While Texas lacks a statewide net metering policy, many local utility companies offer solar buyback programs. These programs allow homeowners to sell excess solar energy back to the grid for bill credits or payments.

What are the potential savings with solar rebates in Texas?

A typical 6-kW solar system in Texas can generate over 9,500 kWh annually, potentially saving homeowners over

FAQ

How do solar panels work?

Solar panels convert sunlight into electricity through photovoltaic cells. A typical home solar energy system includes solar panels, inverters, mounting equipment, and optional battery storage.

What are the benefits of solar power for homeowners?

Benefits of solar power for homeowners include reduced electricity bills, increased energy independence, and a smaller carbon footprint.

How much does a solar installation cost in Texas?

The average cost of a 6-kW solar system in Texas is $16,320 before applying the 30% federal tax credit, which is below the national average.

What is the federal solar tax credit?

The federal solar Investment Tax Credit (ITC) offers a 30% tax credit on the total cost of solar panel installation. For a $15,000 system, homeowners can claim a $4,500 tax credit.

How does the Texas property tax exemption for solar installations work?

Texas offers a 100% property tax exemption for the added home value from solar panel installations. This means homeowners won’t face increased property taxes due to solar panels increasing their home’s value.

What local solar rebates and incentives are available in Texas?

Various utility companies in Texas offer solar rebates, including AEP, Austin Energy, Oncor, SMTX Utilities, CPS Energy, and Denton Municipal Electric. Rebate amounts and eligibility requirements vary.

How does net metering work in Texas?

While Texas lacks a statewide net metering policy, many local utility companies offer solar buyback programs. These programs allow homeowners to sell excess solar energy back to the grid for bill credits or payments.

What are the potential savings with solar rebates in Texas?

A typical 6-kW solar system in Texas can generate over 9,500 kWh annually, potentially saving homeowners over $1,350 per year on electric bills. Combining federal tax credits, local rebates, and ongoing savings, a solar system could have a payback period of 7-8 years.

How do I choose the right solar system for my Texas home?

Selecting the appropriate solar system depends on factors such as home energy consumption, roof size and orientation, budget, and available incentives. It’s recommended to obtain quotes from multiple providers and consider factors like warranty offerings, customer service, and industry experience.

,350 per year on electric bills. Combining federal tax credits, local rebates, and ongoing savings, a solar system could have a payback period of 7-8 years.

How do I choose the right solar system for my Texas home?

Selecting the appropriate solar system depends on factors such as home energy consumption, roof size and orientation, budget, and available incentives. It’s recommended to obtain quotes from multiple providers and consider factors like warranty offerings, customer service, and industry experience.